When science meets finance: A winning solution that reimagines how banks measure risk

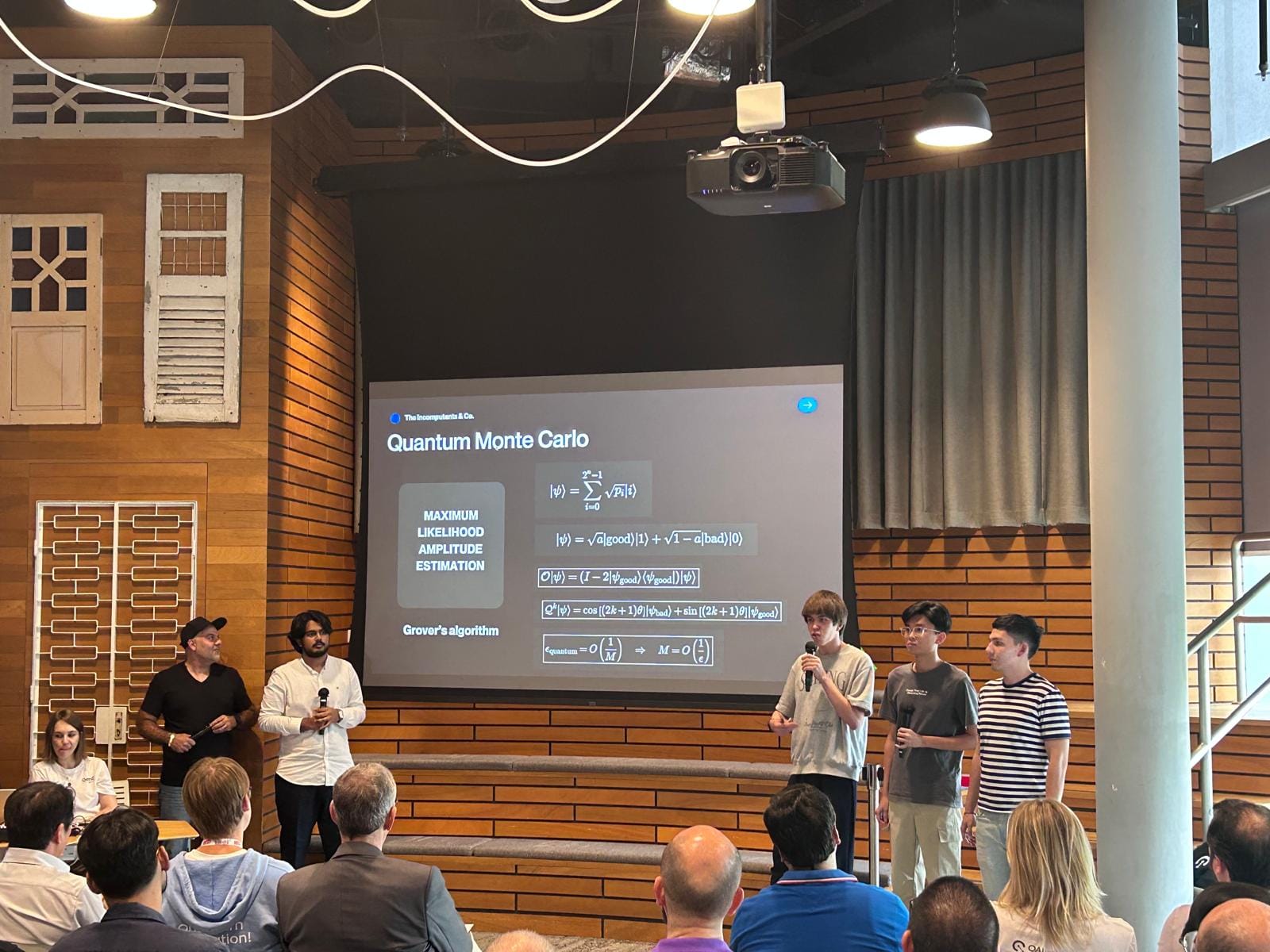

November 19, 2025Congratulations to Physics and Engineering Science undergraduate Vora Yugam Jinesh, whose team – The Incomputents & Co. – edged out competitor teams to emerge the winner of the Credit Risk Counterparty challenge at the Quantum Finance Hackathon held in October 2025!

In a world where code meets creativity, the story of The Incomputents & Co. unfolds as s a testament to the power of interdisciplinary thinking. What started as a hackathon quickly evolved into a testbed for big ideas – the kind that challenge how we compute risk and imagine the future of financial technology.

For Yugam, the path to this moment began in the lecture halls of physics and engineering science – fields dedicated to decoding the logic behind chaos. In our conversation with him, we find out how the most impactful solutions often emerge at the point where disciplines collide.

What inspired you to take part in this competition?

The spark for joining the hackathon was born out of my fascination with systems – how complexity can be modelled – which I have actively applied through quantitative projects in algorithmic trading and statistical arbitrage. When the competition presented a direct challenge in computational finance that explicitly called for the kind of first-principles, analytical approach I’ve developed through my coursework, it was an opportunity I could not pass up. The chance to apply advanced concepts from both classical and quantum computation to a high-stakes financial problem was irresistible.

What real-world problem did you address?

In the intricate world of financial risk management, our team set out to address a problem that sits at the very heart of how banks stay solvent and secure: calculating Potential Future Exposure, or PFE. In essence, PFE quantifies the maximum expected loss that a financial institution would suffer if a party in a derivatives contract defaults. But calculating this accurately, especially for a large portfolio of interconnected assets, is computationally very costly. It requires running a vast number of simulations, running into millions of iterations. Our goal was to make this calculation significantly faster and more efficient, which is a critical problem for any institution managing risk.

How did your training in science prepare you for this competition?

Physics and engineering science, at the heart, teach the discipline of breaking complex problems down into their fundamental parts. This way of thinking became the foundation of our approach to the competition. The challenges involved simulating how correlated assets evolve with time – an exercise in probability but also in imagination. To me, it felt familiar. In physics, I study particles that wander unpredictably, governed by chance; in finance, assets move in similar ways. The same mathematics that describes a molecule’s motion can describe the fluctuations of a stock. My academic background allowed me to see these analogies clearly.

What was your winning solution?

Our approach combined two worlds: the precision of classical computing and the emerging power of quantum technology.

We began by rethinking how simulations are run. Traditionally, calculating financial risk is like rolling a dice millions of times – which is very tedious and random. We replaced that randomness with structure, using smarter mathematical techniques to produce the same insights with far fewer ‘rolls’ – which dramatically sped up our simulations.

Then came the quantum twist. We needed to verify the worst-case scenario sitting at the perilous 95th percentile of risk. For that, we employed a quantum algorithm capable of validating that edge much faster. Our work shows how, in the near future, quantum computers could allow banks to verify their riskiest exposures at unprecedented speed.

How did your team come together and what contributions did each of you make?

Our team of five met at the hackathon itself. The incredible diversity of our group was our biggest strength. We had Fyodor from Uzbekistan studying Computer Science, Alen from Kazakhstan studying Finance, Mehdi from Canada – an experienced entrepreneur with multiple companies – and Ming, a Data Science student from the Nanyang Technological University.

Alen’s finance knowledge helped us define the problem, Fyodor and Ming’s computational and data science skills were key to building the models and Mehdi’s industry perspective kept us focused on the real-world application. My background in physics and engineering science allowed me to bridge the financial theory with advanced computational methods, particularly the stochastic modelling and quantum algorithms.

Please share your key learnings from this experience.

The defining takeaway for me was the strength of interdisciplinary teamwork. It was less about finance or physics or coding in isolation – it was about the fluent dialogue between these disciplines. Building the model required finance to define and understand PFE, physics and mathematics to craft the stochastic simulations and computer science to implement the quantum algorithms. The experience proves that boundaries between disciplines are meant to be crossed – and that the most elegant solutions often arise precisely where those boundaries blur.

How has this experience shaped your perspective on science and its applications?

This hackathon reinforced my passion for modelling complex, dynamic systems. It was a tangible demonstration that the abstract tools from physics, mathematics and computer science have profound, real-world applications in solving high-stakes problems.

This experience solidified my view that the most impactful work happens at the intersection of disciplines. It is not just about being a physicist or a programmer or a quant; it is about being able to speak all those languages to build something new. This experience pushes me further toward a career where I can continue to use quantitative and computational modelling to solve complex, strategic problems.

The Quantum Finance Hackathon is the Singapore edition of the QAI Ventures Global Hackathon Series which ran from 24 – 26 October 2025. The global hackathon is a call to action for the next generation of quantum innovators to tackle global challenges using the power of quantum computing.